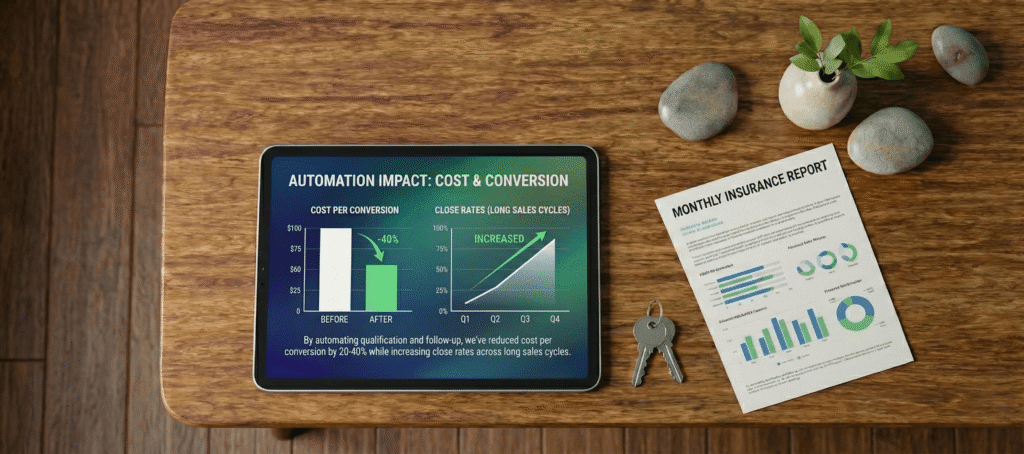

Across insurance providers, demand was never the constraint, systems were.

Leads arrived from ads, referrals, and forms, but without centralized CRMs, pipelines, or automation, agents manually chased prospects, response times lagged, and conversion depended entirely on individual effort.

ROM rebuilt the infrastructure behind insurance operations, replacing inbox-driven workflows with scalable systems that allowed agents to operate independently while leadership retained full visibility.

Quotes Processed

Cost Per Lead

Automated Workflows

Increase in quote-to-policy conversion

The Challenge

Insurance teams relied on disconnected tools, spreadsheets, and manual follow-up.

Leads aged within minutes, pipelines were invisible, and managers had no real insight into performance or leakage. Scaling traffic only amplified inefficiency and agent burnout.

What did ROM do

ROM engineered full CRM systems tailored for insurance workflows.

We built custom pipelines for inbound leads, quotes, renewals, and re-engagement, deployed AI agents for instant qualification and booking, and automated follow-up across SMS, email, and voice so every lead was handled without human delay.

Marketing funnels were rebuilt so traffic only entered systems capable of responding instantly, tracking every interaction, and routing opportunities correctly.

The Results

- Agents stopped chasing leads and focused on closing

- AI agents handled first contact, qualification, and booking 24/7

- Pipelines became visible, measurable, and predictable

- Teams operated independently without constant management oversight

- Growth shifted from agent-dependent to system-driven

The system components behind Insurance Providers

Ready to up your game?

If you’re an insurance agency or agent tired of low-quality leads and empty promises, we help you build a system that actually converts.